In 1981 Allan Meltzer and Scott Richard published a paper that has been taught in a political economics class at MIT. Their simple model starts with two observations.

- People care about both consumption and leisure

- Governments pay for redistribution by taxing the income that labour produces.

When the median voter decides the tax rate under majority rule, the size of government is struggling by the force between mean income and the median voter’s income. If mean income rises relative to the median (more rich people like Bill Gates), the decisive voter has more to gain from taxing richer citizens, so the tax share and redistribution rise. When inequality falls, the preferred tax rate drops.

And expanding the franchise pushes the decisive voter further down the income distribution and also raises the share of income redistributed.

Some view from Indonesia

Where President Joko Jokowi Widodo was re‑elected in 2019 with about ~55.5 % of the vote after his first elected in 2014. As a man-of-the-people, his campaign emphasized how Indonesia had reduced poverty and rolled out new policies

- Th expansion of the infrastructure, ports, toll roads, airports and mass transit lines.

- Kartu Indonesia Sehat (KIS), the social assistance cards that granting poor households access to health care, education, subsidized food and cash transfers

- A Village Fund to channel grants to rural communities

These policies expanded redistribution without large tax increases and targeted the lower end of the income distribution.

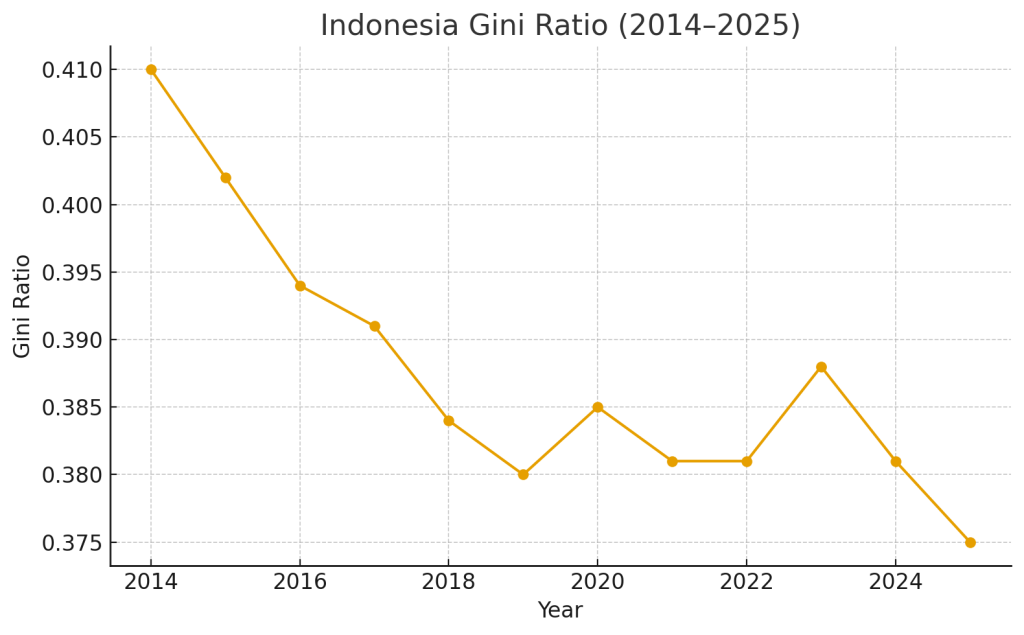

According to the BPS Statistics Indonesia, before Jokowi took the position, Indonesia’s inequality is peaked around 0.4 during 2012-2014. The winning of Jokowi is happen to coincide with this inequality.

After his term from 2014 to 2022, the ratio declined, and poverty rate suggest that average and median incomes are converging. Under Meltzer & Richard’s model this reduces the incentive for the median voter to demand higher taxes.

Now, in October 2024 when Jokowi lost his term to Prabowo Subianto, this might suggests signal from the voters that they get enough of redistribution. It’s time to prosperous as reflected through the budget cutting from fiscal reallocation, launching the Danantara sovereign wealth fund built on state enterprise assets to support investment, while keeping some of the Jokowi’s policy as it is.

Thought

Indonesia over the last decade looks consistent with Meltzer–Richard’s core intuition. When inequality is high, voters rewarded programs that raised the floor. As the Gini and poverty rates slowed down, the same median voter had less reason to push for more tax‑financed redistribution and more reason to back more pie, fiscal reallocation, investment vehicles, and productivity plays. While keeping targeted safety nets that had become politically entrenched.

But this post is just an observation, not definitive. Correlation is not causation, human preferences are more complex, even the Gini moves modestly and with lags and biased.

Meltzer & Richard does give a useful compass, the voters will tell us at the margin where they want policy to move next. And this is one way to look at it.

References

Meltzer, Allan H., and Scott F. Richards. 1981. “A Rational Theory of the Size of Government.” Journal of Political Economy, Vol. 89, No. 5, 914-27.

Leave a comment