On April 3, 2025, equity markets experienced significant volatility following the steep tariffs imposed by Trump. The Dow Jones plummeted and marked the worst day for traders since 2020. This decline raises questions about whether this reaction was a panic sell-off or it’s a sign of the new normal by increased prices and instability.

To navigate through these turbulant times, I believe a strategic approach is essential, resisting reactive decision driven by markets. Instead, the focus should be on identifying and capitalizing on this opportunities.

U.S. Success in Trade Negotiations

The best case for U.S. is that President Trump can secures favorable terms that resulting in lowered tariffs from trade partners, American companies could gain enhanced competitiveness in pricing and improved profit margins across sectors.

While the worst case is when China decided to escalate this trade tension in response to U.S. tariffs, and both are not back down, the situation could worsen in the opposite direction of previous case.

Considering Trump’s profile, he’s well-known as a bold and aggressive leader who has always been believed that China is ripping the US and should be put down. On the other hand, President Xi, he’s known for a calm and strategic leader, as seen in his intiative projects, such as the silk road, and the China aid.

For China, President Xi cannot afford to appear weak in his people perception. Therefore, China is unlikely to back down and take loss, they will sure retailiated. While for U.S., President Trump has a disire to become the most successful president of the United States. With this expectation in mind, it narrows down the possible outcome to TWO ways.

- Partial cooperation

- Fully retaliation

Judging from Trump’s reaction after his administration annouces to prolong the tariff effective date for 90 days, he cares about what market think and feel. So, this evidence limit the full retaliation case, and left with partial cooperation.

Strategic Considerations

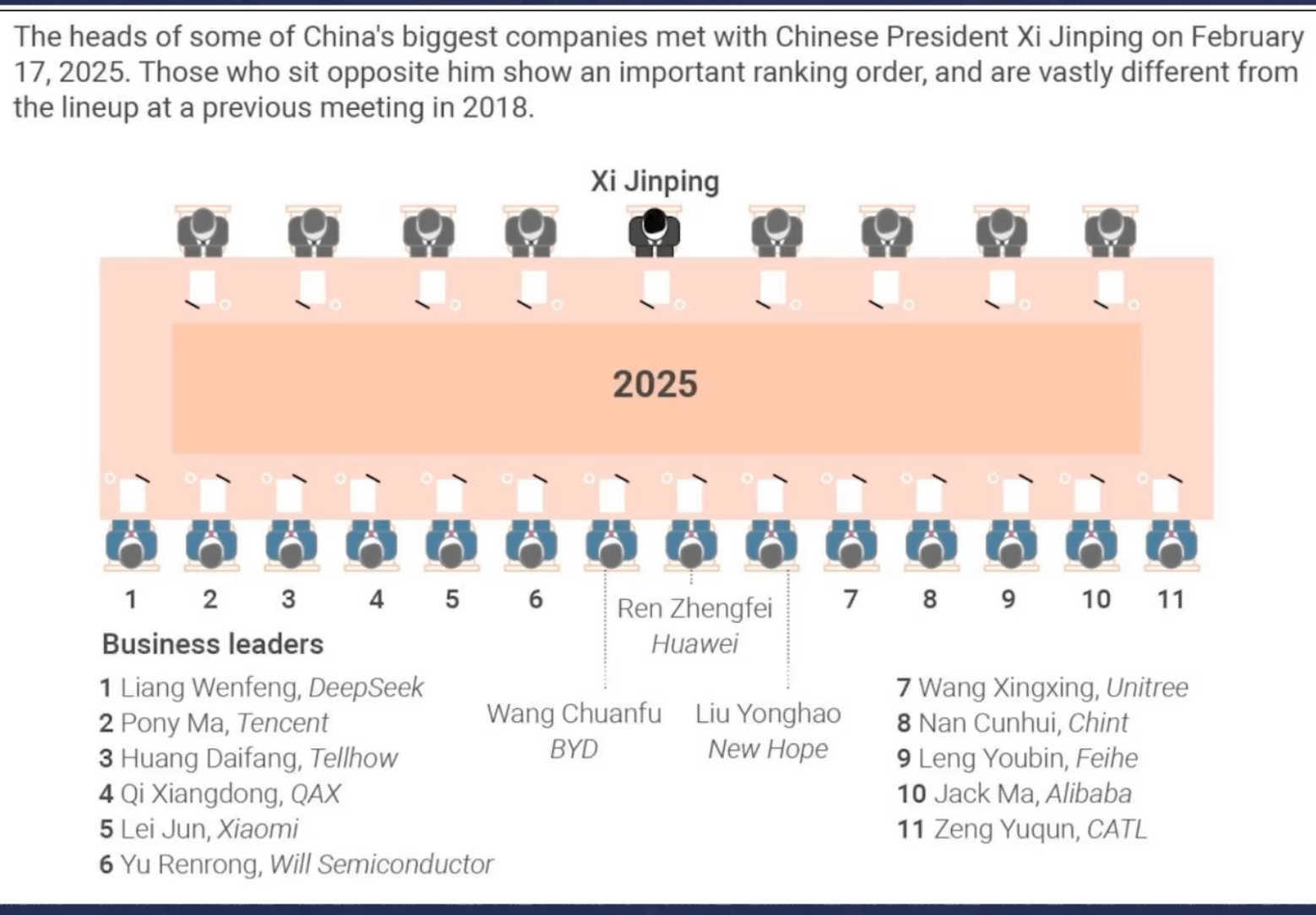

Understanding the priorities of both nations is crutial for make the most out of it. Starts with the lineup at a meeting with President Xi in Febuary, BYD, Huawei, and New Hope were placed as the representative of the most prioritized sectors, automotive, ICT, and argriculture.

Meanwhile, the Trump’s administration emphasizes job security for Americans, aiming to address trade deficits and promote self-reliance, with particular attention to the automotive, metals, and energy sectors.

The automotive sector is notably significant for both nations; the fluctuation of auto-related firms are expected to be volatile, as are the rest of each nation’s strategic sectors. However, one sector that is less prone to receive actual impact from these tariffs is pharmaceuticals; presenting a potential opportunity.

Leave a comment